Importance of COD reconciliation

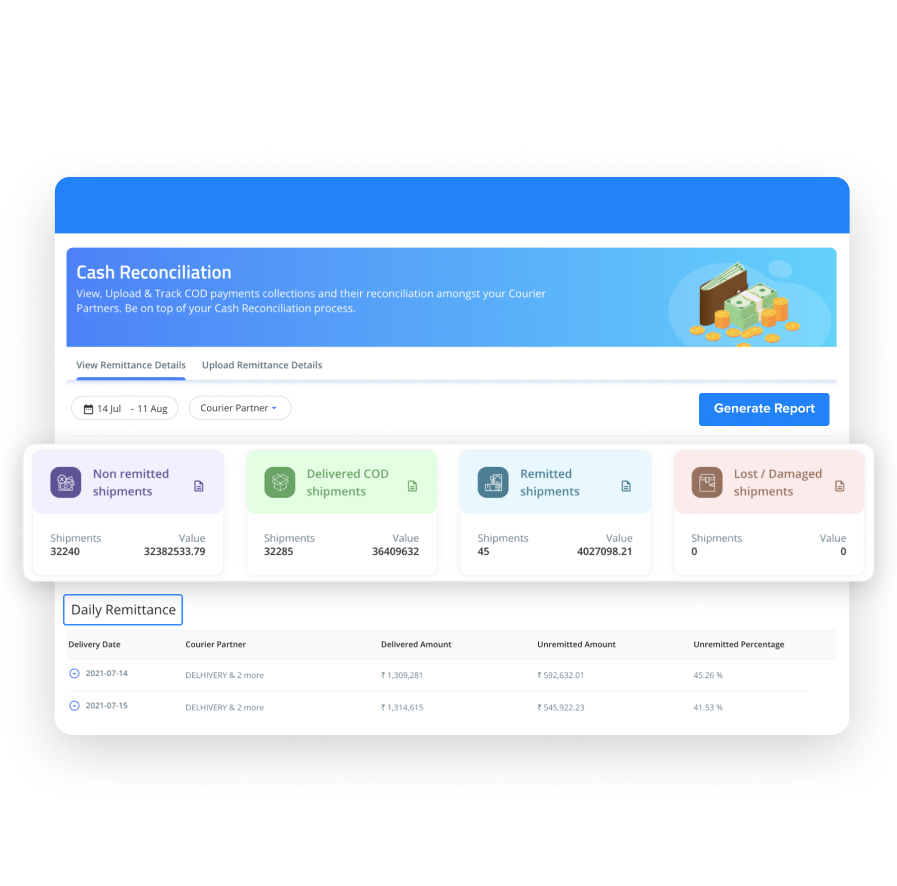

COD orders make up a big percentage of your overall fulfillment requirements. With COD orders, you are also entirely dependent on carriers to regularly and dedicatedly remit the funds from COD orders to you. The problem with that is different carriers have different remittance cycles and policies. But you need your cash flow to remain steady and stable. After all, moving capital is the lifeblood of any functional business. And the last thing you want is the remittance value of any of your orders slipping through the cracks. That’s why it is absolutely essential to monitor COD orders and remittances owed by carriers on a real-time basis. This is what ClickPost enables you to do, segregating the remitted and non-remitted orders, giving you a workflow for retrieving funds for non-remitted orders, and so much more.

How does ClickPost help with the 5 m’s?

Manage all of your COD orders with uniformity

______

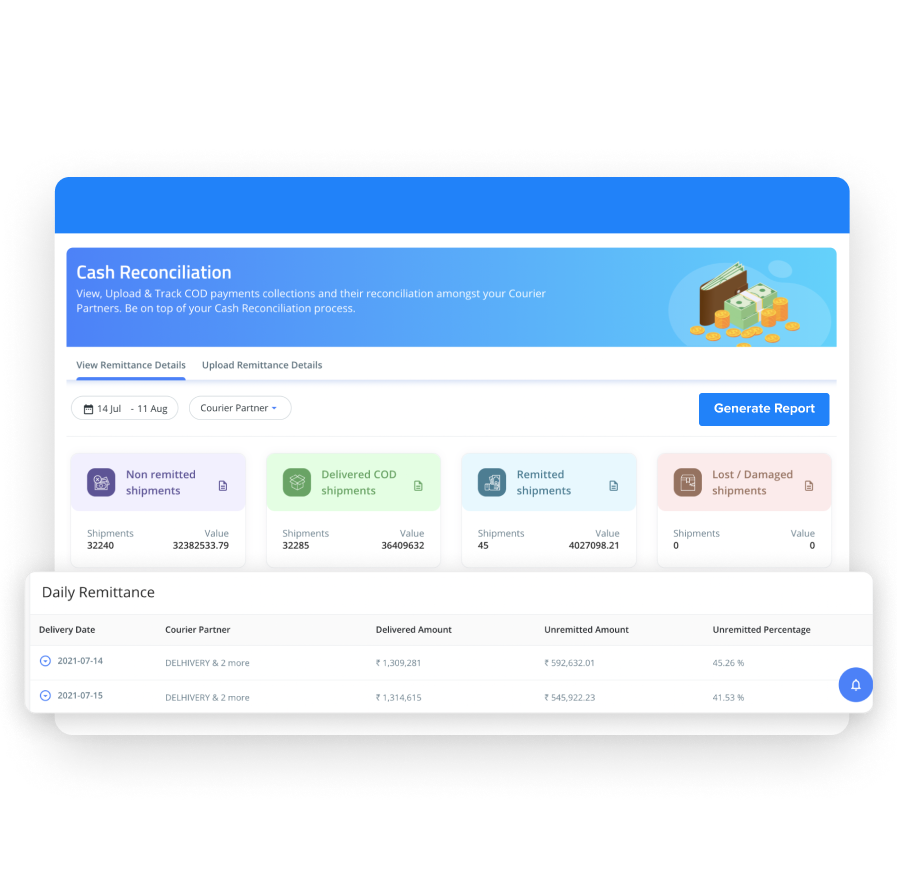

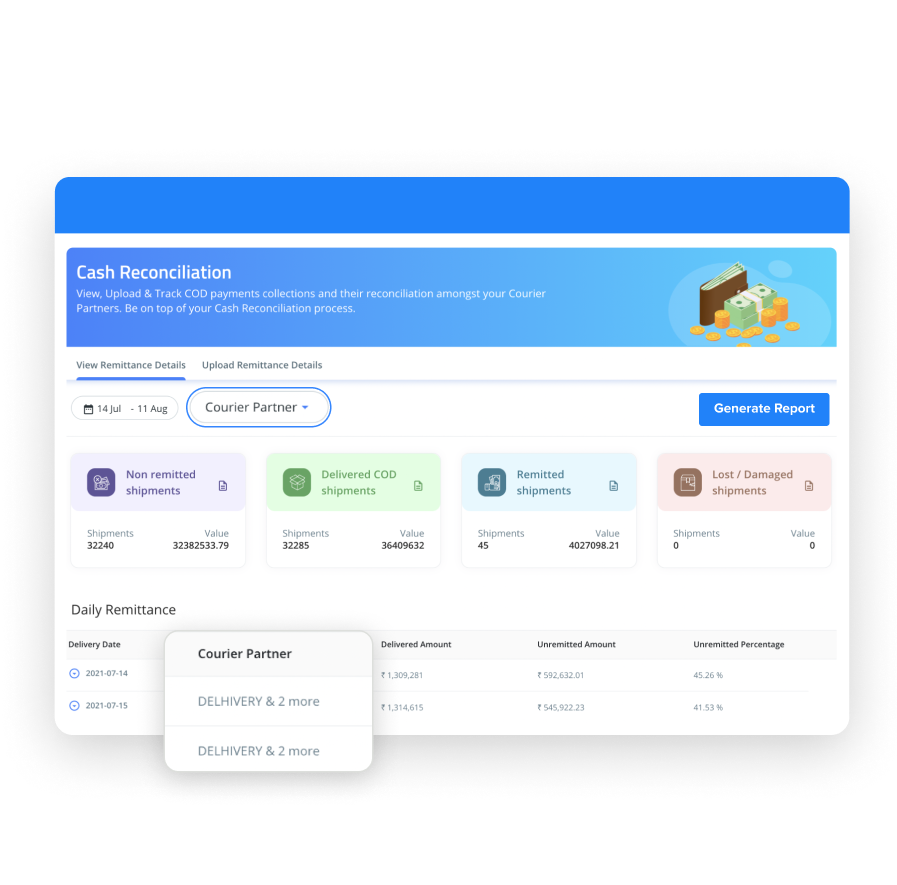

View and track all of your COD remittances from a single specialised dashboard.

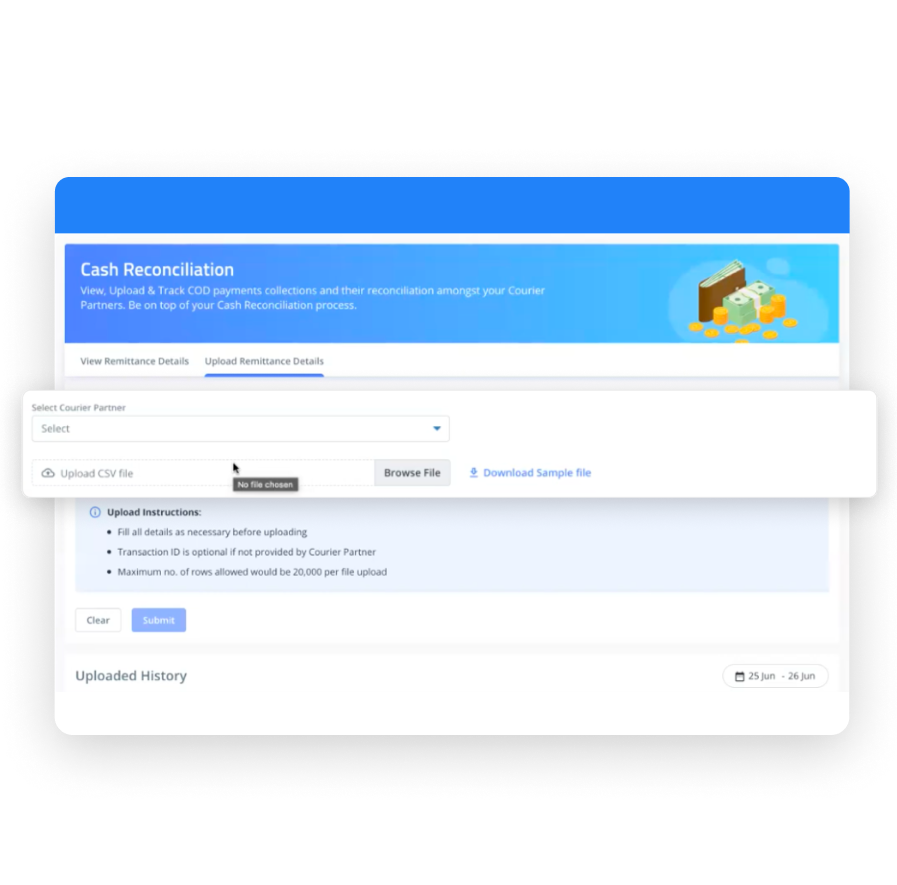

Order statuses can be easily uploaded and updated on the dashboard to enable end-to-end management of all your Cash-on-Delivery orders.

Monitor COD remittance at AWB-level granularity

______

By categorising remitted and non-remitted orders, no orders slip through the cracks.

Each order has it's own independent unique life cycle and each life cycle is tracked in accordance with its cash remittance status.

Maintain a reference log of all COD files for analysis

______

Periodic remittance reports received from carriers are stored and analysed regularly.

These reports contain all information about completed, incomplete and ongoing COD orders to help you make fast decisions for COD reconciliation.

Measure Carrier Patterns Causing Irregular Cash Flow

______

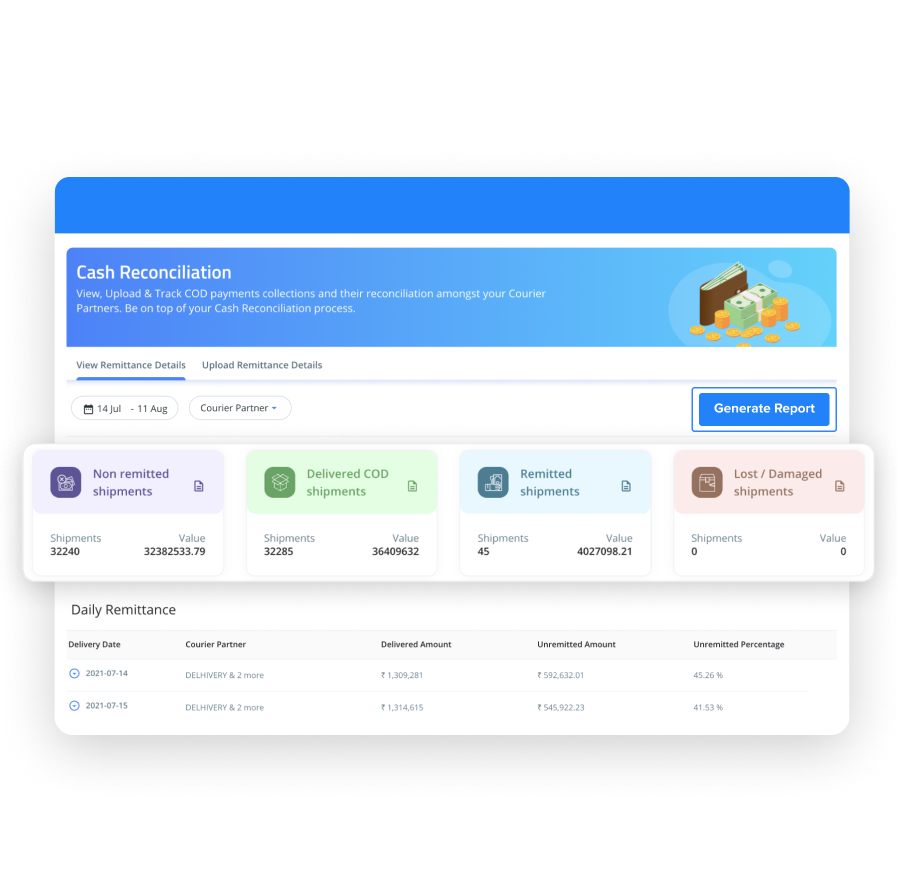

Receive analytic reports that give you actionable insight on carrier COD performance.

With the help of these reports, you can create clearer terms for COD remittance on a regular basis and improve your process for cash remittance.

Minimise discrepancies in your accounting cycles

______

Send carrier non-remittance reports in a workflow to ensure a healthy cash flow cycle.

Carriers are updated in case of delayed COD remittance for all ongoing COD orders which will steadily increase the speed of remittance cycles.

Consequences of unregulated COD remittance

Inconsistencies in accounts discovered only at the end of each billing cycle

Carriers may send COD remittances on a regular basis. However, you will only be able to calculate the unremitted or partially remitted orders at the end of a billing cycle. This leads to bookkeeping inconsistencies.

Difficulties in keeping track of non-remitted COD orders

All information and COD remittance reports are typically managed by a single team. This means that tracking non-remitted COD orders must be done individually. This increases the manual effort expended on COD remittance.

Slow recognition of carrier patterns related to COD non-remittance

Retrieving COD remittances and reports thereof is usually a tedious process, with reports trickling in one at a time. This makes it near impossible to determine which carriers are contributing to the highest percentage of non-remittance.

Low COD remittance leading to irregular cash flow

Money in the bank is a must have for any successful business. But when COD remittances go unchecked, it leaves room for major disparities in COD balances. The unfortunate result is an improper cash flow that can affect business operations.

Benefits of COD reconciliation with ClickPost’s cash reconciliator

1. Manage cash flow cycle

Be aware of exactly which COD orders have been fulfilled, and then carefully track in real-time the orders that have been remitted, partially remitted or unremitted. This ensures you are always aware of exactly how much has been remitted.

2. Analyse cash flow data submitted by carriers

Review the performance of each carrier separately in terms of their remittance cycles. This enables you to better understand which carriers are blocking up your cash flow and the potential causes for any non-remittances.

3.Maintain, store and search through logs of files in a unified location

Discrepancies and customer complaints may arise at later stages. You can quickly pull up the information you require on carrier remittances and specific orders with ease. This enables you to deal with these irregularities efficiently and effectively.

4.Generate and send date-wise non-remittance reports to carriers at an AWB level

Every action needs a reaction, and in case of non-remittance, carriers must be informed on a systematic basis. At a granular AWB level, you can send reports to carriers on their non-remittance.

5.Can negotiate with carriers on remittance cycles

In case a carrier’s remittance performance has proven to be less than stellar, you can use the non-remittance reports generated by ClickPost to determine the best terms for ironing out remittance cycles with the respective carrier.